Aussie CEOs to share insights into investing in Africa

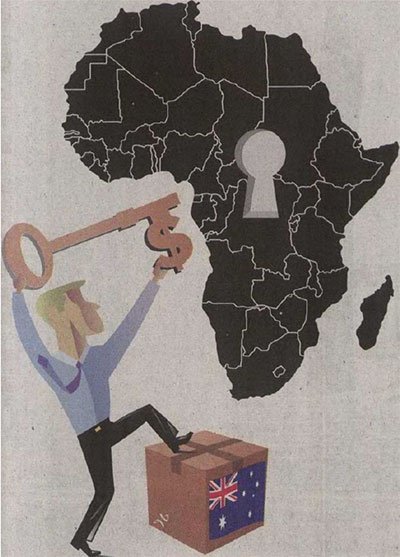

The cartoon published in The Business Times on 06/11/13

The cartoon published in The Business Times on 06/11/13

The following op-ed was published in The Business Times on Wednesday 6 November 2013

by Philip Green

WHAT do Tanzania, Rwanda, Botswana, Namibia and Zambia have in common? Yes, they are all African countries - but no, that's not the answer. Can't get it? Well, they have two things in common, actually. First, they are all countries to which I have previously been accredited in my diplomatic career, much of which has been spent in Africa. And, second, they are all countries with thriving mining industries.

During my first year as Australian High Commissioner in Singapore, I have often been asked how Singapore investors can get more exposure to Africa's fast-growing economies. That's a good question. After all, 11 of the top- 20 fastest-growing economies in the world are in Africa.

More specifically, I have been asked how Singapore investors can get more exposure to African countries' dynamic resource sectors. That is a smart question too - because Africa is estimated to possess a massive 30 per cent of the world's mineral resources.

Well, of course, there are a number of ways to invest in Africa's resources. But one way - perhaps one that is not immediately obvious - is via the many Australian mining companies deeply involved in Africa.

You see, while the focus on foreign investment in Africa's mining sector has been elsewhere, Australian companies - with their expertise drawn from long mining experience on our continent - have been quietly making real headway in Africa. So much so that current and prospective Australian investment in African resource projects is now estimated at around $65 billion.

More than 150 Australian mining and exploration companies have assets on the ground in Africa, with over 650 projects running across 42 countries.

I have had the good fortune to have a close association with this industry. I was part of the opening ceremony for the first modern gold mine in Tanzania. I did the first blast at a new chrome mine in South Africa. And I spoke at the inauguration of a state-of-the-art uranium mine in Namibia. All Australian projects.

So, given the growth of the wealth management business in Singapore, and its evident objective to become an industry with truly global reach, I thought I would put my knowledge of the African mining industry to good use.

I have therefore invited chief executives from a select group of Australian mining companies pursuing an array of projects on the African continent - gold in Burkina Faso, coal in Botswana and iron ore in the Democratic Republic of the Congo (DRC).

These executives will be in Singapore this week to meet potential investors and to provide comprehensive information about how these opportunities can be leveraged.

I invite interested investors to take part in our African mining showcase tomorrow morning at the Australian High Commission. Come and explore how we can maximise the synergy across three continents - "African resources, Australian expertise, Singapore capital".

The writer has been Australia's High Commissioner to Singapore since November 2012. He has extensive experience as a diplomat in Africa, having previously served as High Commissioner in South Africa (with accreditation to Namibia, Botswana, Lesotho and Swaziland), and in Kenya (with accreditation to Tanzania, Ethiopia, Eritrea and Uganda). To register for the Africa Down Under in Singapore event on Nov 7, e-mail [email protected]

Link to online article: http://www.businesstimes.com.sg/premium/editorial-opinion/opinion/aussie-ceos-share-insights-investing-africa-20131106